Nairobi has earned a reputation as the “Gold Scam Capital” of East Africa. Behind the glitzy office suites of Kilimani and the private lounges of Lavington lies a sophisticated network of “Wash Wash” billionaires and international syndicates that have fleeced investors of billions of shillings.

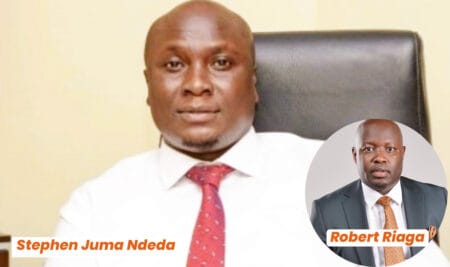

1. The Kilimani/Lavington “Billionaires”

The epicentre of gold fraud in Kenya is often found in the leafy suburbs of Nairobi. These scammers don’t hide; they flaunt.

The MO: They lease high-end office spaces, drive luxury vehicles, and surround themselves with armed “security” to create an illusion of state-sanctioned legitimacy.

The Trap: Victims are invited to these offices, shown genuine gold bars (the “bait”), and introduced to individuals posing as high-ranking government officials or “royals” from neighboring countries.

2. The Fake “Customs” and “Storage” Fees

One of the most infamous and recurring scams involves the fake “holding” of gold at the Jomo Kenyatta International Airport (JKIA) or private vaults.

The Scam: After a victim pays for the gold, the “dealers” claim the consignment has been seized by the Kenya Revenue Authority (KRA) or the Directorate of Criminal Investigations (DCI).

The Extortion: The victim is told they must pay “clearance fees” or “bribes” to release the gold. In one famous 2019 case, a Dubai-based businessman lost over KSh 400 million to a syndicate using this exact method.

3. The “Congo Connection” Syndicate

Many scammers claim their gold is sourced from the Democratic Republic of Congo (DRC) to explain the “discounted” price and lack of initial paperwork.

The Forged Documents: They provide fake “United Nations” clearance certificates or “Congo Mining Permits.”

The Reality: The gold often doesn’t exist, or if it does, it is “conflict gold” that cannot be legally exported, leaving the buyer with a criminal liability instead of an asset.

Top 5 Red Flags of a Nairobi Gold Syndicate

Meetings in Private Homes or Airbnbs: Legitimate gold refineries (like the Gold Refinery of Kenya) do not conduct business in residential living rooms.

The “Tax” Trick: Scammers ask for money to pay for “export taxes” before the gold is shipped.

Use of “Fixers”: If the deal requires a middleman who claims to have “deep connections” with the police or politicians, it is a setup.

Brass and Copper Bars: High-quality brass bars are often coated in a thin layer of 24k gold to pass basic “scratch tests” performed by unsuspecting buyers.

Lack of Fire Assay: Scammers will suggest a “water test” or a simple electronic probe. Only a fire assay test by a licensed laboratory is 100% accurate.

Investigative Sidebar: The Legal Reality

According to the Mining Act, it is illegal for anyone to deal in minerals without a license from the Ministry of Petroleum and Mining. Most “infamous” scammers operate under “trading companies” that have no legal mandate to touch gold.

Sema Yote Warning: If you are approached with a gold deal that seems “too good to be true,” it almost certainly is. The global gold price is public; no one sells it at 30% off unless it is fake or stolen.

Have you encountered a gold scammer? Share your story with our investigative team at tips@semayote.com.